Wellfleet Student plans are designed with the goal of member satisfaction by delivering the right care, at the right place, for the right price. Through a partnership with Cigna, Wellfleet provides its student members access to more than 1 million providers at more than 6,000 facilities nationwide. In addition to having a great network partner, we have a passionate internal team that works tirelessly for our members. This includes customer service, a quality assurance department, and a provider and clinical team, with oversight from our Chief Medical Officer.

Wellfleet’s Provider Network team

Our Provider Network team works closely with network partners and vendors to ensure our members have access to high-quality, in- and out-of-network care. In addition, as faithful stewards to our members, the team works with providers on a case-by-case basis to help reduce their out-of-pocket responsibility and retain the cost for the health plan.

Not satisfied with business as usual

When high-dollar claims come into Wellfleet, several internal teams review them. This is to ensure the bill is appropriate for the care provided. In addition, the steps in their process ensure proper evaluation to provide the fairest outcome for the member and the plan. These high-dollar claims are often appropriate, and the approval is seen as business as usual. However, some raise flags based on things like billing, coding, or prior treatments.

Incorrect billing charges

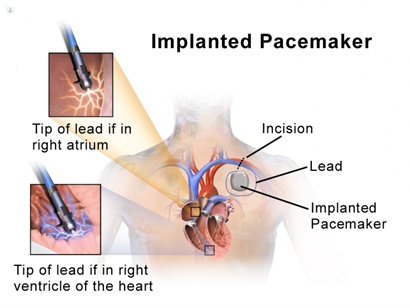

A member had been having minor chest discomfort and scheduled an exam with their physician. After meeting with their physician, it was determined that the pain was related to a failing lead in their pacemaker.

Some pacemakers have three leads – or flexible, insulated wires placed in a chamber or chambers of the heart to aid in pumping blood and adjusting heart rate. Sometimes they can fail due to a loose or broken wire between the pacemaker and the heart, electronic circuit failure, or a fracture in the wire. In this instance, the wire needed to be changed.

The member worked with their physician to schedule surgery to replace the defective lead. They were able to get an in-network appointment, and the procedure went off successfully for the member.

However, the claim that the hospital filed was incorrect. It listed charges that didn’t align with why the member went in for surgery. The payment integrity team found that the plan was charged for an implant, a pacemaker, and new leads. After a thorough investigation, the team confirmed that only the lead was replaced and denied the additional charges.

Their work helped save the plan more than $40,000 and the member more than $4,000 in out-of-pocket fees.

Don’t miss another great savings story! Sign up for our monthly clinical newsletter and get member savings stories in your inbox with other great Wellfleet Student happenings.