One of the largest barriers to students receiving the right healthcare is cost. Many students experience financial strain during college. In fact, 57% of undergraduate students report that they would have trouble finding $500 in an emergency.1

Because students are often tight on finances during college, Wellfleet Student focuses on providing student health insurance plans that reduce the costs of premiums and out-of-pocket medical expenses. Our plans are designed around the needs of students, considering the financial needs of this population.

One aspect of Wellfleet’s cost-consciousness is that we go above and beyond with our claims review process, often securing five or six-figure savings for schools.

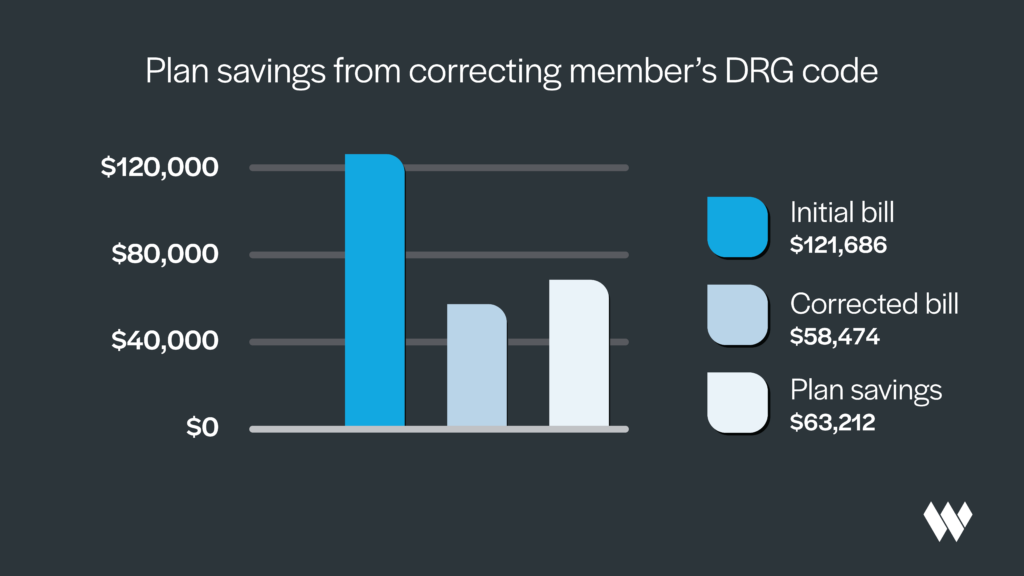

In this blog, read about how we helped a school plan save $63,000 on a claim for a student who experienced a brain bleed.

The case study

Recently, we received a medical claim from a member of one of our student health insurance plans. The member, a current student, had visited the emergency room after experiencing a seizure that lasted about five minutes. The student had never experienced a seizure before.

The provider ordered a CT scan to image the brain, and this revealed a hemorrhage, or a bleed, in the brain. Another image called an angiogram was performed, and this showed that the patient did not need surgery or additional inpatient treatment. The student was able to return home with oral medication.

Though the patient underwent a standard workup and had no additional complications from the seizure, the bill we received was not aligned with this. The diagnosis related group, or DRG, for this claim, was listed as intracranial hemorrhage or cerebral infarction with major complications.

Our team thoroughly reviewed the patient’s record and identified that the patient should not have been billed for complications, then approached the provider to reconcile.

Correcting the error on the bill resulted in significant savings for the member’s school plan.

School savings from correcting the bill

The original bill Wellfleet received from the provider was for $121,686, which we determined to be an inflated cost because the patient’s bill was upcoded, charging for complications when none occurred.

When we applied the correct coding, the new cost of the patient’s care was reduced to $58,473. Our one correction to the patient’s bill resulted in $63,212 of savings to the member’s school plan. These savings will play a significant role in helping to keep premium costs low for this school’s students next year.

How our team saves money on claims

Because Wellfleet is focused specifically on serving the college student population, we’re hyper-aware of the financial needs of students. We know the value of keeping premiums and out-of-pocket costs low.

One way we keep costs low is through our rigorous claim review process. Our Payment Integrity team reviews all the high-dollar claims we receive to ensure the patient was billed appropriately for the services provided.

When we uncover mistakes, we correct them, which often results in significant savings for the student and school.

See the other ways Wellfleet Student saves money for schools and students.

How school plan savings affect student costs

When evaluating the cost-effectiveness of various student health insurance plans, it’s important to understand how plan savings affect students. While many of our billing reviews lead to out-of-pocket student savings, such as in this case, sometimes the savings take the form of school plan savings. But even in these cases, there are still significant trickle-down effects to members.

That’s because health insurers like Wellfleet use each plan’s past performance to determine premium rates for the next year. So, if a school’s members incur more high-cost claims, the premiums for the next year will be higher than if they would have had lower claims dollars.

Our claim scrutiny process lowers costs for students by lowering overall plan spend. Lower costs incurred by the school plan help keep future premiums lower than if we would have paid every high-dollar claim in full without correcting billing mistakes.

Read another savings case study, where we found $210k in plan savings on the birth of twins.

Learn more about Wellfleet Student

To learn more about developing a tailored student health insurance plan that puts you and your students first, reach out to our Sales team.

References

1 Fletcher, C, et al. (2023, May). Student Financial Wellness Survey. Trellis Research. https://www.trelliscompany.org/wp-content/uploads/2023/05/SFWS-Aggregate-Report_FALL-2022.pdf.

CSR-SHIP-JANUARY-2024-6