As the leading provider of student health insurance plans that are tailored to students’ needs, Wellfleet Student understands how important it is for students to have access to quality care at an affordable price.

College students have a lot to focus on besides the cost of their healthcare — academics, extracurriculars, friendships, career planning, and family, to name a few. That’s why the Clinical team at Wellfleet scrutinizes each claim to ensure students are billed correctly.

Our rigorous claims review process helps save money for schools and students. Our team regularly finds major cost reductions, sometimes even reaching into the five or six figures. This can translate into out-of-pocket savings for the member as well as premium savings for the plan.

Our review process helps secure cost savings for our members and partner schools and reduces the overall cost of student health insurance.

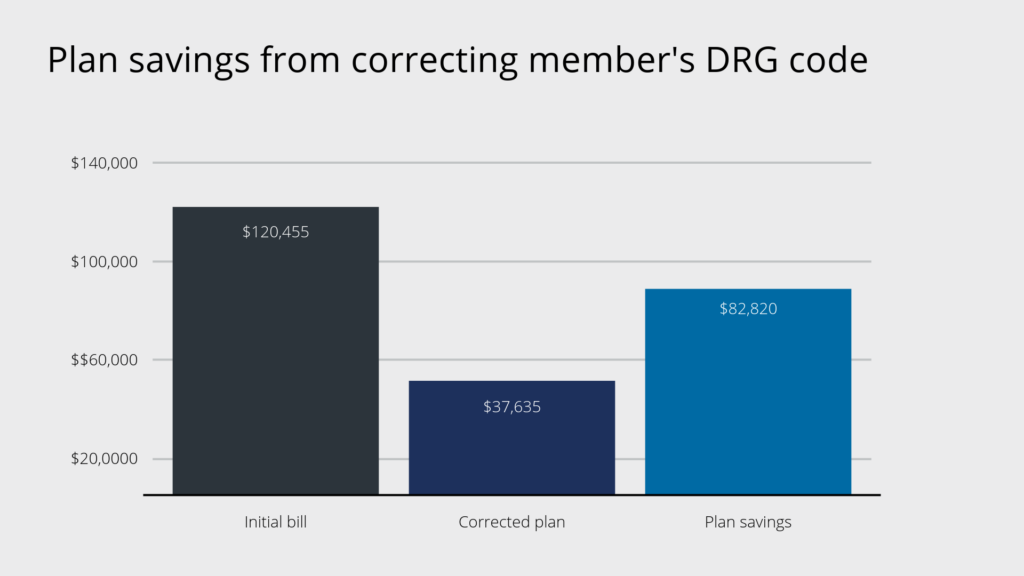

In this savings case study, we’ll walk you through how our team secured $82,000 in plan savings and $873 in member savings — all by fixing incorrect billing when a member with diabetes needed surgery.

The case study: Surgery needed to control an infection

Recently, a Wellfleet Student member required surgery for an infection. The patient had preexisting type 1 diabetes mellitus (DM), which is a condition where the body’s pancreas makes little to no insulin, a hormone that’s necessary to regulate glucose (sugar) in the body.1

Patients generally get diagnosed with type 1 DM as children or adolescents, though it can appear later in life.1 This disease has no cure, and patients are managed closely using insulin as well as lifestyle modifications to mitigate further issues.1

One common side effect of diabetes is an increased susceptibility to certain bacterial infections.2 That’s because high glucose in the blood can hinder the body’s immune response to pathogens.2

Our student member experienced infection complications from their diabetes. Years before the infection, the member had a rhinoplasty with a nasal implant to improve their breathing. The member’s recent infection began with a sinus infection, which then infected the nasal implant and acted as a source for infection. Because the infection had moved to the implant, it needed to be removed surgically to resolve the infection.

The member was admitted to the hospital and underwent surgery for implant removal. Blood glucose levels were monitored, and the patient experienced a high heart rate. The member was also tested for COVID-19 and found to be negative. After a successful recovery, the patient was discharged without any complications five days post-surgery.

Though the reason for surgery was clearly to resolve an infection, and the member recovered well without complications, their billing revealed another story. That’s when our team jumped in to fix mistakes that were significantly inflating the cost of care.

What our team uncovered

When our team reviewed this member’s surgery claim, we realized that the claim had been incorrectly billed by the facility.

The claim was given a diagnosis related group (DRG) code for an operating room procedure for injuries with major complications, which our team identified as incorrect.

First, the member didn’t need surgery because of an injury. Rather, surgery was needed to treat the member’s infection. Additionally, the coding stated that the patient experienced major complications. It was clear through reviewing the member’s chart that there were no notable complications from the procedure. There was a minor unspecified elevation in heart rate and insulin administration, which is to be expected with the patient’s diabetes. Neither of these warranted the upcoding that was seen on the patient’s bill.

Our team fixed the mistakes by correcting them to a more appropriate DRG, which changed the total billed amount from $120,455 to $37,673, a savings of $82,820 for the plan. This coding correction also led to out-of-pocket member savings of $873, and the student ended up only needing to pay $132 out of pocket for this claim.

Interested in another savings case study? See how we secured $210,000 in plan savings on a claim for the birth of twins.

How our team saves money on claims

The Wellfleet Student team works hard to ensure members get the very best student health insurance at the most affordable cost. To aid in keeping costs down for the plan and for students, we thoroughly vet every high-dollar claim we receive, checking the coding alongside the patient’s record to ensure no errors were made.

Upon noticing a mistake, we further investigate the claim and identify the correct coding for the claim. We then communicate the correction with the provider and send them the correct payment. The savings we secure for the plan benefit the schools by helping to keep future premiums low.

That’s because when we correct billing mistakes and reduce the cost of healthcare services, this lowers yearly spending for the school plan. Because future premiums depend on prior years’ performance, lower plan spending can translate to savings in premium costs the following year.

Additionally, student health plan members often benefit directly by paying less in out-of-pocket expenses for their care, as the member experienced in this case.

Because Wellfleet is a student health insurance carrier fully dedicated to students, we know how important it is to keep out-of-pocket costs and premiums low for students. Students deserve health insurance that fits within their budget, so at Wellfleet we go the extra mile to keep costs down for our partners and members.

Read up on the other ways Wellfleet Student saves money for schools and students.

Learn more about Wellfleet Student

To learn more about developing a tailored student health insurance plan that puts you and your students first, reach out to our Sales team.

References

1 Mayo Clinic Staff. (2023, September 15). Type 1 diabetes. Mayo Clinic. https://www.mayoclinic.org/diseases-conditions/type-1-diabetes/symptoms-causes/syc-20353011.

2 Nagendra, L, Boro, H, and Mannar, V. (2022, April 5). Bacterial Infections in Diabetes. Endotext. https://www.ncbi.nlm.nih.gov/books/NBK579762/.

Wellfleet is the marketing name used to refer to the insurance and administrative operations of Wellfleet Insurance Company, Wellfleet New York Insurance Company, and Wellfleet Group, LLC. All insurance products are administered or managed by Wellfleet Group, LLC. Product availability is based upon business and/or regulatory approval and may differ among companies.

CSP-SHIP-OCTOBER-2023-1