The Wellfleet Rx team pays attention to costs — both for students and schools. That’s because we understand how important it is to keep healthcare costs low for students.

Data shows that 73% of enrolled undergraduate students experience financial difficulty while in school,1 which is why we make it a priority to reduce healthcare costs. Not only do lower costs cause less financial strain on students, but they also make healthcare more accessible.

At Wellfleet Student, we use several cost-saving strategies to help reduce healthcare costs for members of our student health insurance plans. Utilization management (UM) is an important way the Wellfleet Rx team helps students save on medications. Year after year, the strategies we’ve used have consistently yielded savings for our members and partner schools.

In this blog, we’ll share our how our team secured an average of $73 in savings per member per year for the 2022-23 school year using utilization management.*

How much savings through utilization management?

During the 2022-23 school year, our utilization management strategies resulted in an average savings of $73.44 per member per year.*

To add context to this value, consider a school with 2,500 members on the student health insurance plan. A savings of $73 per member would translate to $183,600 in savings across all the school’s members — a major reduction in costs.

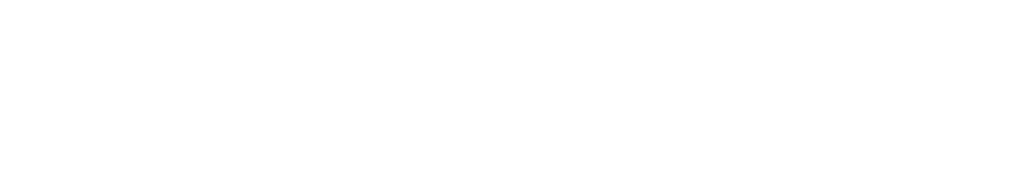

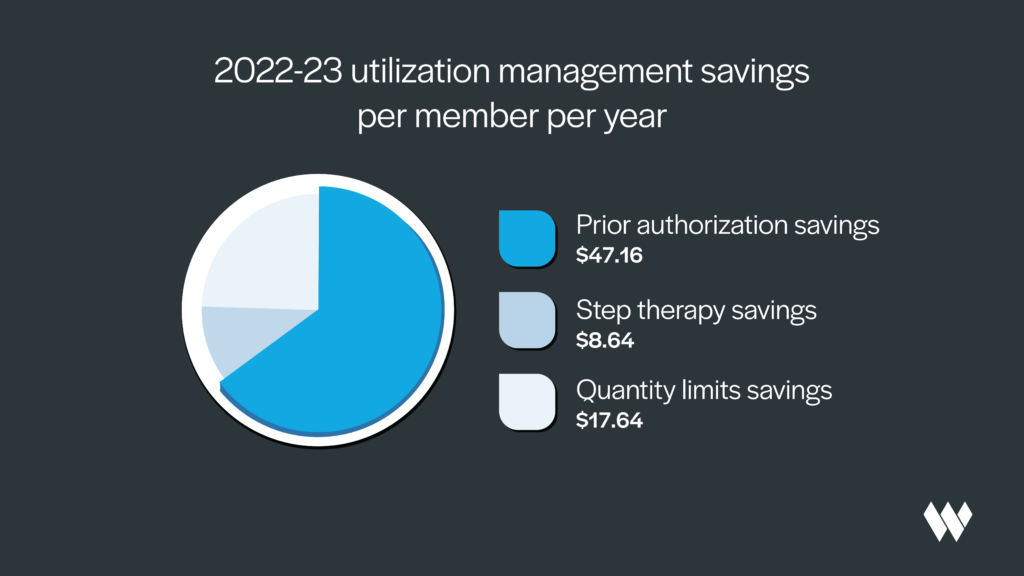

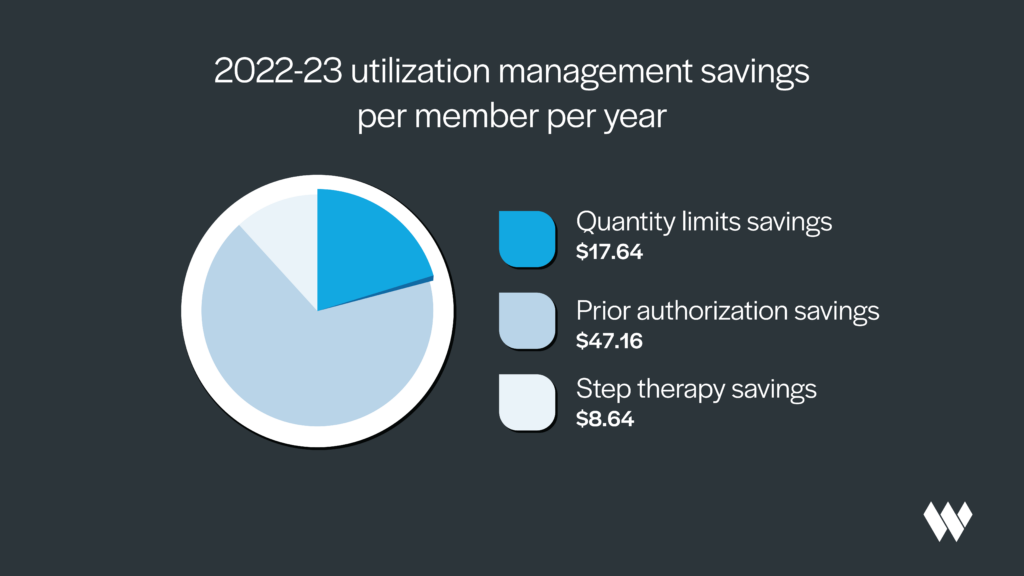

Now, let’s break down these savings and categorize them based on the three UM strategies the Wellfleet Rx team uses: step therapy, quantity limits, and prior authorization.

Want to know what medications are covered? View the current Wellfleet Rx formulary.

What is prior authorization?

Prior authorization is the process by which certain treatments or medications need to be reviewed by the patient’s insurance company before approval will be given. Each insurance company has unique guidelines for which treatments need prior authorization.

When evaluating a medication, the Wellfleet Rx team looks at several factors:

- Safety and efficacy of the medication

- Appropriateness of the medication to treat the patient’s condition

- Cost of the medication and whether a less expensive, equally effective alternative exists

Prior authorization savings

During the 2022-23 school year, our prior authorization protocols resulted in a total savings of $47.16 per member per year.

For a 2,500-member school, our prior authorization strategy would have saved the plan approximately $117,900 per year.

What are quantity limits?

Another utilization management strategy we use to reduce medication costs for members of our student health insurance plan is quantity limits. These are parameters on the amount of medication provided, and they align with the FDA-approved instructions for each medication.

For example, if a student was prescribed a pain medication following surgery, the Wellfleet Rx team would ensure the prescription reflected clinical guidelines for that medication.

Quantity limits help ensure patients get the correct amount of medication for their condition. And they can also reduce medication costs by avoiding having patients pay for unneeded medication.

Quantity limits savings

During the 2022-23 school year, the Wellfleet Rx team secured a total savings of $17.64 per member per year using quantity limits.

For a 2,500-member school, this value would translate to approximately $44,100 of savings per year for the plan, thanks to quantity limits.

What is step therapy?

The third method we use to save money for student members on their medications is step therapy. This involves taking a progressive approach to medication selection.

Starting with lower-cost medications, patients only progress to more expensive brand-name medications if the lower-cost options fail.2 If patients try a lower-cost medication and it does not work, we’ll then cover a “step-up” medication, such as a brand-name medication. Step therapy ensures patients are trying the lowest cost treatments first, which can help them reduce their copay and thus decrease medication costs.

Additionally, because the Wellfleet Rx formulary contains 40+ medications with a $0 copay, sometimes step therapy can help patients reduce their medication costs to $0 if one of the approved $0 copay options successfully treats their condition.

Step therapy savings

Our step therapy protocol can result in one of a few outcomes:

- The original prescription may be approved

- A different medication may be prescribed

- No drug may be prescribed

In the 2022-23 school year, our step therapy protocols resulted in a total savings of $8.64 per member per year.

For a hypothetical school with 2,500 health insurance plan members, step therapy would have saved the plan approximately $21,600 per year.

How does utilization management benefit schools and students?

Now that you understand utilization management, you may be wondering about the benefits of these savings to students and schools.

Wellfleet Rx’s utilization management strategies can positively impact our student members in several ways:

- Increased confidence that you’re receiving the most appropriate medication

- Optimized medication dosage and quantity

- Cost-effectiveness with your medications

Additionally, utilization management can benefit schools by lowering the overall plan spend for the year. Because future premiums depend on past plan performance, lower costs can help combat inflationary rises in premiums the following year.

Total savings from utilization management

During the 2022-23 school year, our utilization management program successfully secured $73 in savings per member per year for our student health insurance plans.

How else does Wellfleet save money for students and schools? See how we found $4,300 in student savings and $196,000 in plan savings by fixing a billing mistake.

Learn more about Wellfleet’s student-centric pharmacy solution

Created for students, Wellfleet Rx tailors our formulary to students’ specific needs. We’re committed to providing our members with the right medications at the right price, and that’s why our formulary includes 40+ medications with a $0.00 copay.

Connect with us to learn more about how Wellfleet can create a tailored health insurance plan and pharmacy solution for your students.

Resources

1 Fletcher, C, Cornett, A, and Ashton, B. (2023, May). Student Financial Wellness Survey. Trellis Research. https://www.trelliscompany.org/wp-content/uploads/2023/05/SFWS-Aggregate-Report_FALL-2022.pdf.

2 Wellfleet (2023). Outcomes UM conversions PY 22-23. Retrieved January 26, 2024. Unpublished company document.

3 What is step therapy? https://www.healthinsurance.org/glossary/step-therapy/.

*Calculated savings are the average per member per year savings for all participating members nationwide during the 2022-2023 plan year (8/22-5/23). Individual savings may vary based on health needs and plan terms. This average is for general understanding and not a guarantee of individual cost savings.

CSR-SHIP-DECEMBER-2023-19