Students have unique priorities regarding their healthcare. Two of the most important are affordability and access.

Because students often have limited ability to work during school, and the costs of their education can be high, they may struggle financially. According to Trellis, 73% of undergraduate students reported experiencing financial difficulty during school, and 57% would have difficulty finding $500 in an emergency.1 Considering students’ financial reality, lowering healthcare costs is crucial for this population.

Additionally, access to care can be a significant hindrance to care for students. Students are often inexperienced at navigating the complicated healthcare system, and finding the right providers that provide the most affordable care can be difficult. The traditional provider network system can place strict limits on where students can get care, which is why we sought to find a way to provide greater freedom and access to care.

By reimagining how student health insurance plans are built, we can lower costs of care while also improving students’ access to the care they need.

What is True Choice by Wellfleet?

As a health insurer specifically focused on serving college students, Wellfleet concentrates on creating the best insurance coverage for students. We crafted True Choice to help reduce healthcare costs and improve care for our students.

True Choice does away with traditional provider networks, giving students more freedom while reducing their cost of care. So, while PPOs restrict members to the “in-network” providers to receive discounted care, True Choice removes this barrier, letting members choose from a larger number of providers.

While most health plans expect members to use in-network providers, the True Choice plan makes all providers accessible to students.

We negotiate with providers to determine a fair price for their services — using data from Medicare, actual costs, accepted payments, and negotiated rates. According to data regarding the use of this payment model within the commercial health plan space, 96% of providers accept a data-driven fair price.2

By carrying over this data-driven approach to claim negotiations, we’re able to provide a health insurance plan that retains the exceptional coverage of our other SHIP plans while adding the benefits of increased provider choice and reduction of costs.

In fact, True Choice has a projected premium savings of up to 20% when compared to a commercial PPO plan.3

Key benefits and features of True Choice:

- ACA-compliant student health insurance plan

- More plan designs and more provider choices for students

- A student-centric plan with reduced out-of-pocket costs

- Wellfleet Rx with $0.00 copays on over 40 highly used medications

- “Student Health Center first” approach rounded out with a comprehensive health plan, including:

- Access to more providers

- Behavioral healthcare solutions

- Telehealth care

- Inclusive care

How does True Choice work?

With True Choice, we use the reference-based pricing model — which has been widely used among employer health plans for years — and apply it to the student population.

Most health insurance plans pay a set price for health services, and these rates may vary widely by location and provider. For example, wrist surgery from one provider may be billed much higher than the same surgery with another provider at a different hospital.

While PPOs apply a standard discount to the healthcare bill, with True Choice, we pay a fair market price for services rendered. Using data from Medicare, actual costs, accepted payments, and negotiated rates, we determine a fair price for the care provided to the member and pay accordingly. Results vary by provider, and some providers may choose to negotiate the final price.

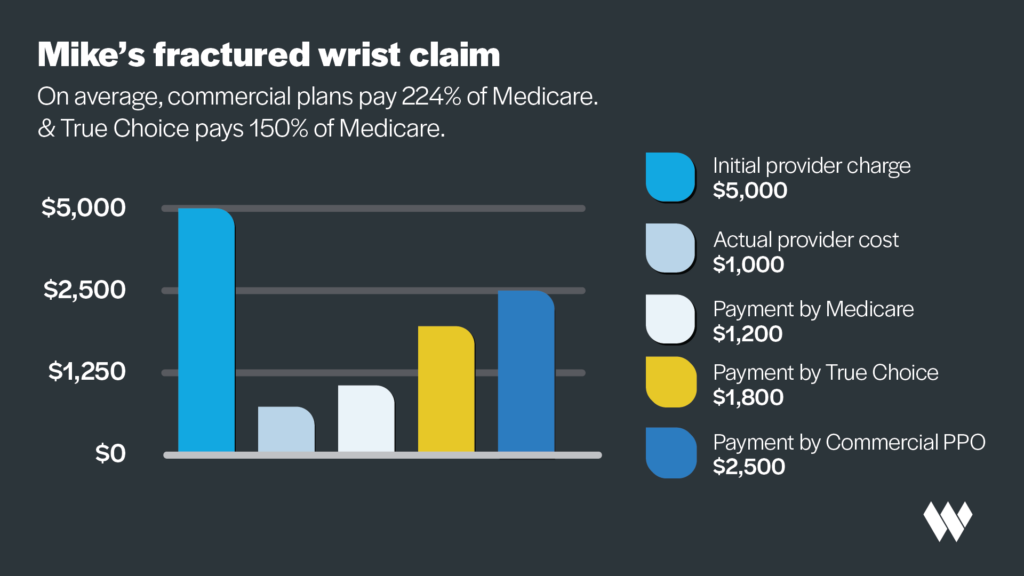

By following this model, we can reduce the costs of healthcare services for our students. While the average rate paid by commercial plans is 224% of Medicare, reference-based pricing models pay an average of 150% of Medicare.4

Refer to the illustration below for a visual representation of how these numbers may look for a hypothetical patient with a fractured wrist.

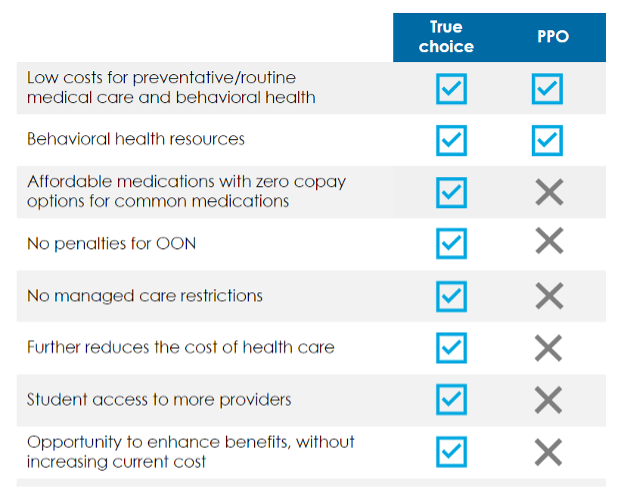

Wellfleet’s True Choice compared to traditional PPO student health insurance plans

True Choice offers several notable differences when compared to a traditional commercial health insurance plan.

The primary advantages of True Choice compared to traditional PPO plans include:

- Comprehensive coverage and benefits at a lower cost

- More freedom for students to choose where to get care

- Comparable member cost share across all providers

- Low-cost medications, including 40+ with a $0.00 copay

- Customer service team dedicated to students

True Choice FAQs

Here are a few of the main questions we get about how the True Choice plan works in the real world. If you have additional questions, reach out to our team, and we’ll provide any additional information your school needs.

Will providers recognize and accept the True Choice accept health plan?

Wellfleet’s True Choice plan is an ACA-compliant health plan with robust coverage and provider reimbursement rates that average higher than Medicare,4 so most providers should accept this plan without any issues.

When students seek care at a provider’s office or hospital, they should show their Wellfleet ID card, which will display their school and Wellfleet logo, coverage, and billing information. If a provider hasn’t worked with the True Choice plan and has questions, they can contact Wellfleet’s customer service team via the phone number on the card to assist with questions.

How can students find providers?

Students can find a provider in several ways. The True Choice plan has no limitations restricting which providers patients can visit. Here are a few of the options for finding a provider:

- Students may use the Wellfleet Student mobile app or website to find a local provider.

- The provider locator identifies providers who have previously accepted members.

- Students may contact Wellfleet Customer Service for assistance locating a provider and scheduling an appointment.

- Students may use the Wellfleet Student app to access telehealth and virtual care.

How does the True Choice plan compare to Wellfleet’s other student health plans?

Student health is Wellfleet’s focus, so all our plans are student-centric, focusing on the specific needs of this population. Wellfleet has traditional PPO health plan options, which provide similar care and coverage compared to the True Choice plan. The primary differences between our PPO plans and the True Choice plan are the lack of network restrictions and additional cost savings that the True Choice plan offers.

Learn more about True Choice for your campus

With the high costs of healthcare in today’s age, finding ways to lower healthcare costs for students can help them access care more easily.

That’s why we created True Choice — to make getting the right care easier and less expensive.

Learn more about Wellfleet’s True Choice Student Health Insurance Plan by visiting our site. Connect with our team to see how a tailored True Choice health plan can benefit your students.

References

1 Fletcher, C., et al. (2023, May). Student Financial Wellness Survey Fall 2022 Semester Results. Trellis Research. https://www.trelliscompany.org/wp-content/uploads/2023/05/SFWS-Aggregate-Report_FALL-2022.pdf.

2 AMPS. (2023) The More you know member packet. Data provided by AMPS regarding the commercial use of the reference-based pricing model.

3 Average client savings based on Wellfleet’s 2022-23 plan year claims data. Savings vary based on plan structure, performance, and client.

4 RAND Corporation. (2022, May). National Evaluation of Health Care Prices Paid by Private Health Plans. https://www.rand.org/pubs/research_reports/RR4394.html.

CSR-SHIP-FEBRUARY-2024-01