At Wellfleet, customer centricity and operational excellence are key tenets that guide us. Our Payment Integrity Program is born out of those key beliefs and upholds our commitment to the Triple Aim – the right care, at the right price, to the member’s satisfaction.

With a sharp focus on the Triple Aim, our team is actively verifying that all claims received are for eligible members from legitimate providers and that Wellfleet is the carrier responsible for payment. This includes ensuring billing adheres to payment policies, meets standard medical protocol guidelines, and is not wasteful or abusive.

This proactive approach is one of the many ways Wellfleet Student differs from other student health insurance carriers. With roots as a TPA (Third-party Administrator), we know that every dollar counts. So, we collaborate with our partners to go above and beyond to deliver more significant savings for our clients and student members. This helps ensure student members receive the best pricing for their services while assuring providers are being paid appropriately for services rendered.

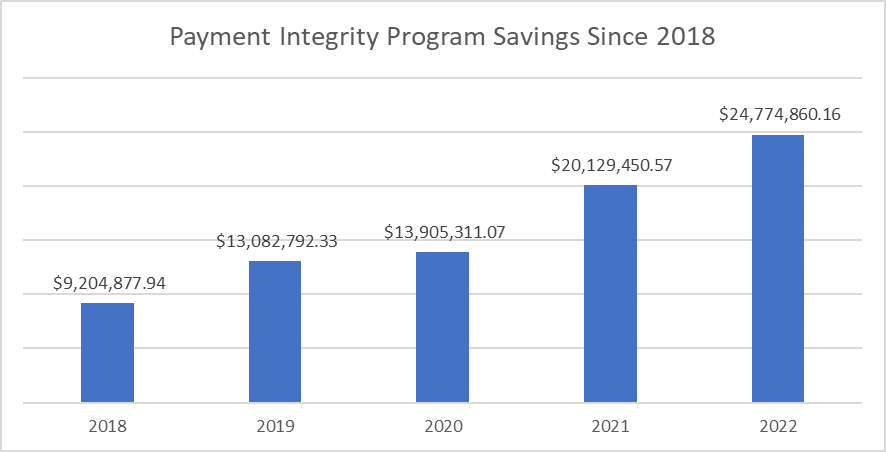

When reviewing how the program has saved our client plans, our data shows that we’ve helped save them more than $81 million since 20181; see the chart below!

To help contextualize the savings, our team conducts three types of analysis to ensure school plans and student members are charged appropriately. They are Pre-Payment Analysis, Out-of-Network Discounts, and Waste and Abuse. Here are the details of each.

Pre-payment analysis

Verifying that we’re paying the appropriate amount for services rendered is essential to manage the cost of care for our clients and student members. To do this, Wellfleet has an orchestrated process using intelligent technology and capable team members to validate billing and procedure.

To ensure the best outcome for our clients, we do our first phase of billing review before it goes to our clients and members. We look at multiple factors, including where the service was provided (in/out-of-network, ER), what service(s) were provided (Ambulance, x-ray, surgery, diagnosis), as well as policy and coding alignment.

We want to ensure that the provider is not billing for a higher level of service than what was performed. Again, this is done on both inpatient and outpatient claims.

The collective group of individuals doing the work is known internally as our payment integrity team. Although their work is done behind the scenes, their due diligence has saved clients and members millions of dollars.

In 2022, their work helped save more than $7.2 million. Further, over the last five years, they’ve helped save more than $31.3 million!1

Out-of-network discounts

We also work with our provider network to get the best in- and out-of-network rate possible. However, negotiating out-of-network charges can be challenging. That’s why we have a dedicated team that works with providers countrywide to obtain discounts for the services rendered. Using aggregated, anonymized data they’re able to identify appropriate rates to pay based on condition and services provided.

In 2022 alone, our efforts helped reduce total out-of-network expenses for clients and members by $17.3 million.1

Waste and abuse

Another area of our billing analysis pertains to errors, waste, and abuse. This review involves a detailed analysis of claims by provider and type of service. So here, systems leverage aggregate data and established guidelines to compare typical procedures and outcomes for a particular provider.

If outliers are identified, there is a deeper dive to uncover the ‘why’. Once the reason is established, action is taken to approve or deny the claim. There is follow-up with the provider on specific denials to help educate and ensure smoother interactions in future cases.

This program also includes post-payment reconciliation. This is all part of our constant improvement process, as well as our commitment to member savings. Because our database is constantly growing, we have the potential to uncover trends that may not have been apparent at the initial review. If we find items that should have been addressed, we’ll follow up with our providers to reconcile. We then provide credits back to our clients and update our process to prevent reoccurrence.

In 2022, this program saved clients and members more than $180,000.1

Continuous improvement of the payment integrity program

In thinking of what’s best for the clients and their members, we revisited our payment guidelines to identify areas we could update.

One area we investigated was what “standard” really means for “standard procedures.” We found some of the policies were vague and didn’t align with new medical research and advances. So, we referenced several industry authorities, including the American Medical Association, and updated them. This helped us implement more modern standards to ensure stricter scrutiny and member-friendly outcomes.

An area where we’re constantly evolving is with new procedures. Many significant procedural enhancements have occurred in the last few years. With these advances, there may not be new coding or standards. However, when these situations arise, we scrutinize them because we want to understand the procedure better and pay accordingly. Often, these are positive experiences for us and the provider – because it helps streamline interactions and ensures proper payment across the board.

Member satisfaction – our ‘North Star’

The goal of our payment integrity program is to help control costs for our clients and members. We want to ensure that they are satisfied with the cost of care they are receiving.

We strive to do the most that we can to provide member satisfaction. It’s as simple as that. That’s why we work so hard at building member-focused programs and resources.

Learn more about our member focused programs.

Resource

1 Wellfleet (2023, February). 2018-2022 – YoY Payment Integrity Savings. Retrieved February 15, 2023. Unpublished company document.