At Wellfleet, customer centricity and operational excellence are key tenets that guide us. Our Payment Integrity Program was born out of those key beliefs, upholding our commitment to provide the right care at the right price to the member’s satisfaction.

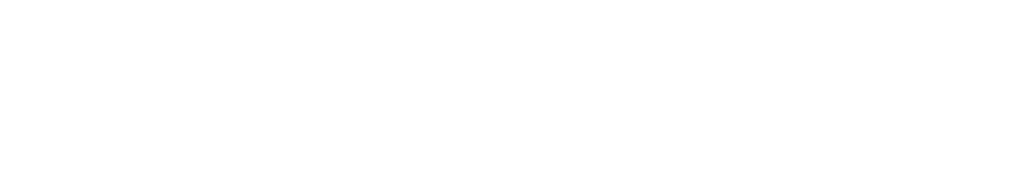

In this blog, see how our intensive claims review process has saved $109 million for school plans since its inception in 2018.

How our claims review process works

Our Payment Integrity team thoroughly reviews the claims we receive, ensuring that they are for legitimate providers and services and that all the bill details are correct. We identify the correctness of billing and check that the claim meets standard medical protocol guidelines.

Our proactive approach to reviewing claims is a key differentiator between Wellfleet and other student health insurance carriers.

With roots as a TPA (third-party administrator), we know that every dollar counts. That’s why we go above and beyond to deliver savings for our clients and student members.

Our claim review process helps student members receive the correct pricing for their services while ensuring providers receive appropriate payment for their services.

Our team completes three types of analysis to ensure school plans and student members are charged appropriately.

1. Pre-payment analysis

The first way we manage the cost of care for our clients and students is by verifying that we’re paying the right amount for services rendered. We confirm whether the proper billing procedure was followed and our members were charged the correct amount.

We look at multiple factors, including:

- Where the service was provided

- What services were provided

- Whether the provider bill aligns with the level of service provided

- Whether the proper coding was used

In this phase of review, we want to ensure that the billing aligns with the service that was provided. We perform these reviews on both inpatient and outpatient claims.

Read about how our review process saved $4,300 for one student and $196,000 for the school plan!

In 2023, this work helped save more than $8.1 million. Further, over the last six years, we have helped save more than $39.5 million for school plans through pre-payment analysis!1

2. Out-of-network discounts

Another way we secure savings for our school plans is through working with providers to get the best in- and out-of-network rates possible.

Out-of-network negotiations can be challenging, which is why we have a team that interacts with providers nationwide to obtain discounts. Using data, they’re able to identify fair payment rates based on the patient’s condition and the services that were provided.

In 2023 alone, our efforts helped reduce total out-of-network expenses for clients and members by $19.1 million.1 Since 2018, we have saved a total of $68.3 million through out-of-network discounts.1

3. Waste and abuse

Another way we help plans save money on claims is through the identification of errors, waste, and abuse. Our systems perform a detailed analysis of claims, using aggregate data and established guidelines to compare typical procedures and outcomes.

If outliers are identified, we dive deeper to uncover the reason. Once the reason is established, we approve or follow up with the provider to discuss the details and ensure prompt and appropriate payment.

Additionally, because our database is constantly growing, we have the potential to uncover trends that may not have been apparent at the initial review. If we find items that should have been addressed, we’ll follow up with our providers to reconcile. We then provide credits back to our clients and update our process to prevent reoccurrence.

Our waste and abuse processes saved $770,000 for school plans in 2023.1 Since the program’s inception, we’ve secured $1.3 million in savings through these processes.1

How our claims process saves money for schools and students

When evaluating the cost-effectiveness of various student health insurance plans, it’s important to understand how plan savings affect schools and students.

While many of our billing reviews lead to out-of-pocket student savings, such as in this case, sometimes the savings take the form of school plan savings. Even if there are no direct student out-of-pocket savings, members can still see trickle-down effects to reductions in future premiums.

That’s because health insurers like Wellfleet use each plan’s past performance to determine premium rates for the next year. So, if a school plan incurs more high-cost claims, the premiums for the next year may be higher than if they would have had lower claims dollars.

Our claim scrutiny process can help lower future plan costs and student costs by lowering overall plan spend. Lower costs incurred by the school plan help keep future premiums lower than if we had paid every claim in full without correcting and optimizing the billing.

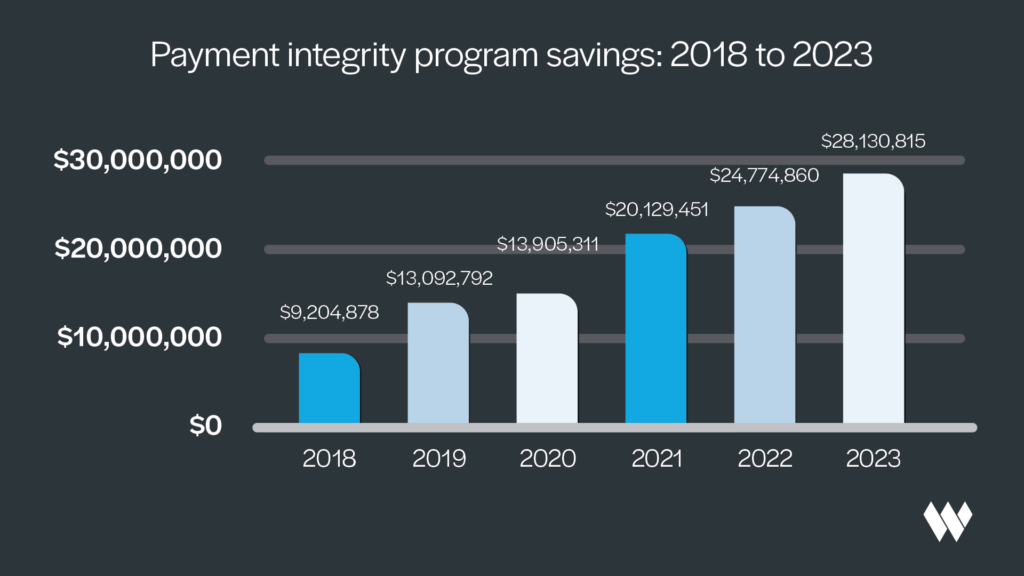

Total savings: $109 million

When reviewing how the program has saved our client plans, our data shows that we’ve helped save them more than $109 million since 2018.1 In fact, every year since it began, our program has secured an increased savings amount for our clients.1

As you can see in the chart above, our Payment Integrity program has succeeded in identifying and producing savings opportunities for our students. Our work has only just begun, and we’re committed to keeping future student health insurance costs low through our dedicated claims process.

Learn more about Wellfleet’s 30-year history of advocating for students.

Learn more about how we reduce costs and optimize care

At Wellfleet, we’re dedicated to controlling costs for our clients and members. We work hard to help ensure our members are satisfied with the quality and cost of care they receive.

Connect with our team to learn more about how Wellfleet goes the extra mile to provide quality care for our members while simultaneously reducing plan and member costs.

Resources

1 Wellfleet (2024, March). 2018-2023 – YoY Payment Integrity Savings. Retrieved March 5, 2024. Unpublished company document.

CSR-SHIP-MARCH-2024-11