Wellfleet Student plans are designed with the goal of member satisfaction, by delivering the right care, at the right place, for the right price. Through a partnership with Cigna, Wellfleet provides its student members access to more than 900,000 providers at more than 6,000 facilities nationwide. In addition to having a great network partner, we have a passionate internal team that works tirelessly for our members. This includes customer service, a quality assurance department, and provider and clinical team, with oversight from our Chief Medical Officer.

Wellfleet’s Payment Integrity team

Our Payment Integrity team works closely with network partners and vendors to ensure our members have access to high quality, in- and out-of-network care. As faithful stewards to our members, the team works with providers on a case-by-case basis, to help reduce their out-of-pocket responsibility and retain cost for the health plan.

Not satisfied with business as usual

When high-dollar claims come into Wellfleet, there are several internal teams that review them. This is to ensure the bill is appropriate for the care provided. The steps in their process ensures proper evaluation, to provide the fairest outcome for the member and the plan. Most times these high-dollar claims are appropriate, and the approval is seen as business as usual. However, some raise flags based on things like billing, coding, or prior treatments.

New onset of type 1 diabetes results in ICU admission

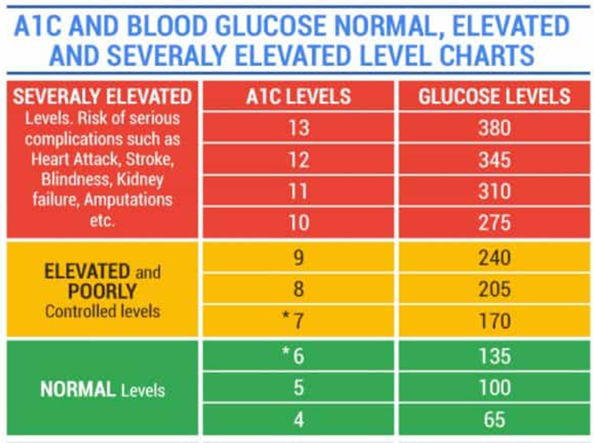

Recently, while visiting their primary care provider, a student member mentioned that over the last two months they had an increasing thirst they could not quench, coupled with fatigue and frequent urination. After running some tests, doctors found the member’s blood sugar to be in the 300 mg/dl range – which is about three times the normal rate and could be fatal if left untreated; see chart below .

From here, the doctor diagnosed the member with type 1 diabetes, immediately placed them on an insulin drip and moved them to an ICU where they could be monitored hourly. After several hours, the student’s blood sugar stabilized. However, out of an abundance of caution the doctors had the member remain at the hospital for further monitoring.

While monitoring the student member, doctors noticed an abscess on their thigh. Unfortunately, abscesses can be common among those with diabetes, because the changes in blood sugar levels can leave skin more susceptible to bacterial and fungal infection. So, they numbed the area and performed a bedside incision to drain the abscess.

The procedure was successful, and on the fourth day the member was discharged in stable condition, armed with information and a plan to manage their type 1 diabetes.

Coding for operating room procedure not justified

While the scenario that played out is a fairly typical one, it was scrutinized by our payment integrity team due to potentially high plan and member out-of-pocket costs. Upon reviewing the billing codes and notes on file, the payment integrity team found that things did not line up.

Coding in the file showed treatment for diabetes with major complications and operating room procedures. While there was treatment for diabetes, there was nothing in the file to imply major complications. Further, the notes specifically stated the abscess was treated bedside — not in an operating room. Due to this error, the payment integrity team worked with the provider to update the coding to align with the treatment provided.

The updated coding reduced the overall cost to the school’s plan by more than $100,000 and the member’s out-of-pocket expenses by more than $5,000!

Learn more about the Wellfleet Student payment integrity program and how it upholds our commitment to the Triple Aim – the right care, at the right price, to our members’ satisfaction – for our clients and members.