As the only health plan built specifically for students, Wellfleet Student works hard to help students and schools save money. In this blog, you’ll hear about how our student health plan lowered plan costs and member out-of-pocket costs on the birth of a baby.

Wellfleet Student is committed to the needs of students, and we understand that affordability is a big deal for those in college. So, we work hard to ensure students aren’t overcharged for their healthcare services.

That’s why our Clinical team scrutinizes every high-dollar claim to ensure members were billed for services correctly. If we notice errors, we fix them and communicate with the provider to resolve the claim. Our team often identifies cost reduction opportunities, sometimes well into the five or six figures.

In this savings case study, you’ll see how our team found a billing mistake on the birth of a newborn and how fixing the mistake saved the member $4,317 in out-of-pocket costs and saved the plan $196,000.

The case study: Birth of a healthy newborn

Recently, a member of our Wellfleet student health insurance plan became the parent of a healthy baby, delivered via cesarean section.

Initially, after birth, the baby experienced breathing difficulties, as indicated by low oxygen levels. Interventions performed by the facility’s clinical team worked to stabilize the infant. The baby was then brought to the neonatal intensive care unit because oxygen levels kept going down. After a few hours of continued care, the baby was weaned to room air with high-flow oxygen. The baby transitioned off oxygen on day three after birth, and the chest x-ray was negative for neonatal distress syndrome. After a smooth recovery, the baby was able to be discharged home with the parents on day five.

The facility’s clinical team determined that the baby’s respiratory challenges were likely caused by exposure in the womb to the mom’s antidepressant medications. The baby stabilized and quickly strengthened thanks to breathing and oxygen support provided by the care team.

What our team found

Now that you understand the background of this newborn’s experience, let’s dive into what our Clinical team found when reviewing the claim for the newborn’s hospital stay.

As we’ve discussed in prior case studies, each medical claim has a diagnosis related group (DRG) associated with it. This code determines how the claim is billed, so it’s important that this DRG is correct. When we reviewed this baby’s bill, we saw that the assigned DRG code was “extreme immaturity or respiratory distress syndrome, neonate,” which we determined was incorrect.

First, the baby was full-term at 38 weeks gestation, and thus, it was not immature. As we discussed earlier, while the newborn did have some breathing challenges post-birth, it did not receive the clinical diagnosis of neonatal distress syndrome because this condition was not indicated on a chest x-ray.

Additionally, the diagnosis “neonatal distress syndrome” did not match the baby’s clinical picture because this condition is generally caused when a baby is premature and thus does not develop enough surfactant in the lungs before birth. This baby was born at 38 weeks gestation, so the baby had plenty of time for surfactant to develop.

Despite some initial breathing challenges, which were promptly resolved with interventions like CPAP and oxygen, the appropriate DRG code should have been “normal newborn.”

Running the numbers

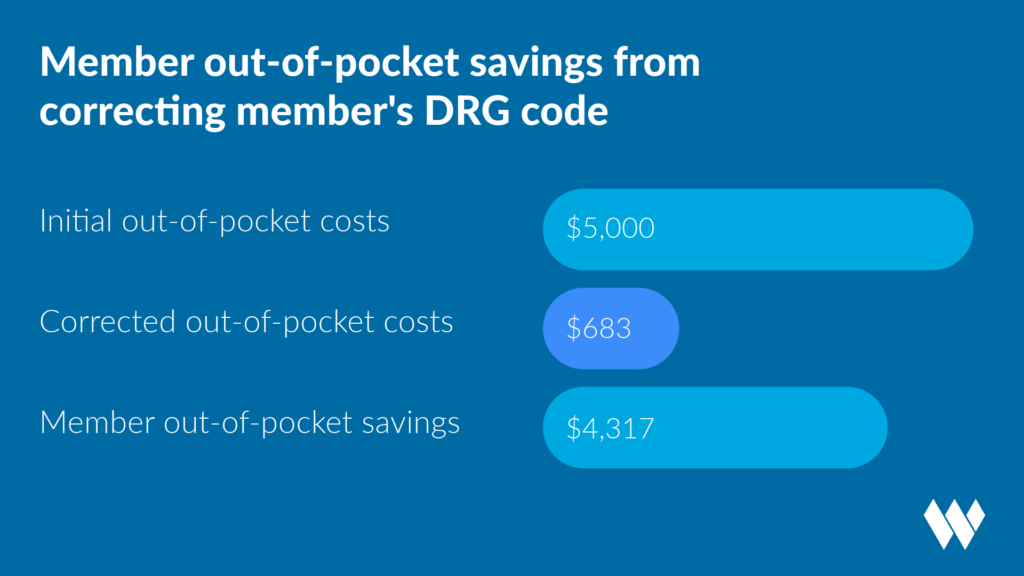

Member savings

When we corrected the DRG code to reflect a “normal newborn,” we were able to secure significant savings for the member as well as the plan. The member’s out-of-pocket costs decreased from $5,000 to $683, a savings of $4,317. This is a significant cost reduction for a student, especially one who’s a new parent. Our dedication to students is why we work so hard to correct billing mistakes and lower costs.

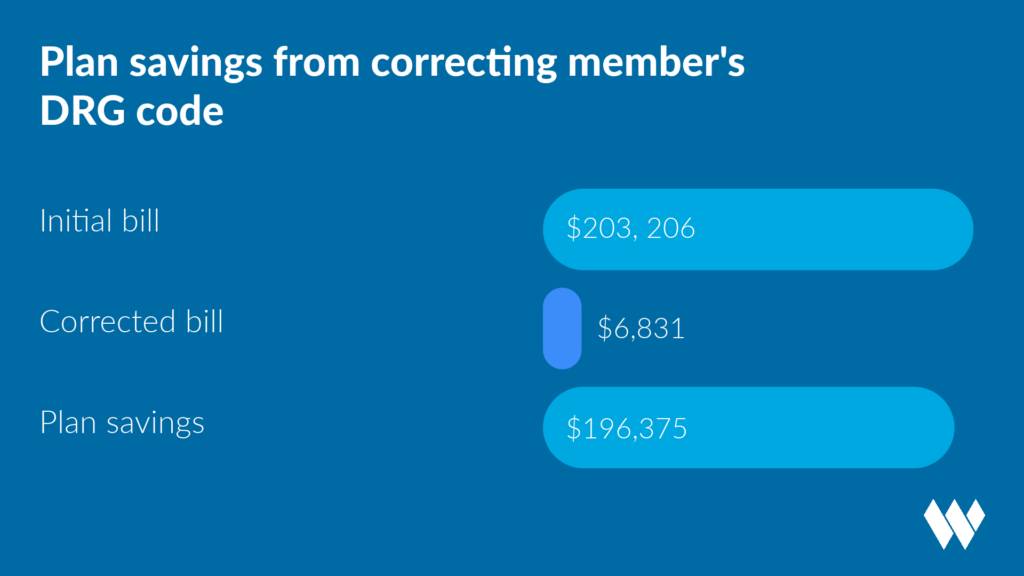

Plan savings

In addition to the member out-of-pocket savings, this correction also led to huge plan savings, lowering the cost from $203,206 to $6,831, a reduction of $196,375.

These lowered costs translate to lower yearly plan spend for the school. Because the prior year’s plan spend is used to determine future premium levels, lower plan spend means lower future premiums for members.

Not only do low premiums benefit the school by improving student access to healthcare, but they also make healthcare more affordable for students.

Interested in another savings case study? In this case, our team secured $82,000 in savings on a surgery.

How our team saves money on claims

At Wellfleet Student, our team focuses on providing our members with the best student health insurance at the most affordable cost. To keep costs down, we vet every high-dollar claim we receive, confirming correct coding to ensure members weren’t overcharged.

If we see a mistake, we review the member’s record, identify the correct coding for the claim, and work with the provider to resolve the claim.

The savings we find often directly benefit the student by lowering out-of-pocket costs. Additionally, reducing yearly spending benefits the school plan by keeping future premiums lower.

As a health insurance carrier fully dedicated to students, we know how important it is to keep student costs and premiums low. Students deserve care that fits their budget, so we go the extra mile to make healthcare affordable.

Learn about the other ways Wellfleet Student saves money for schools and students.

Learn more about Wellfleet Student

To learn more about developing a tailored student health insurance plan that puts you and your students first, reach out to our Sales team.

CSP-SHIP-OCTOBER-2023-5